IRS receipt requirements are $75, meaning you do not have to necessarily produce receipts for the smallest expenses. IRS deductions paid cash with no receipt will not sit well with the U.S. Whenever you make a purchase or pay a business-related bill, get a receipt for it.

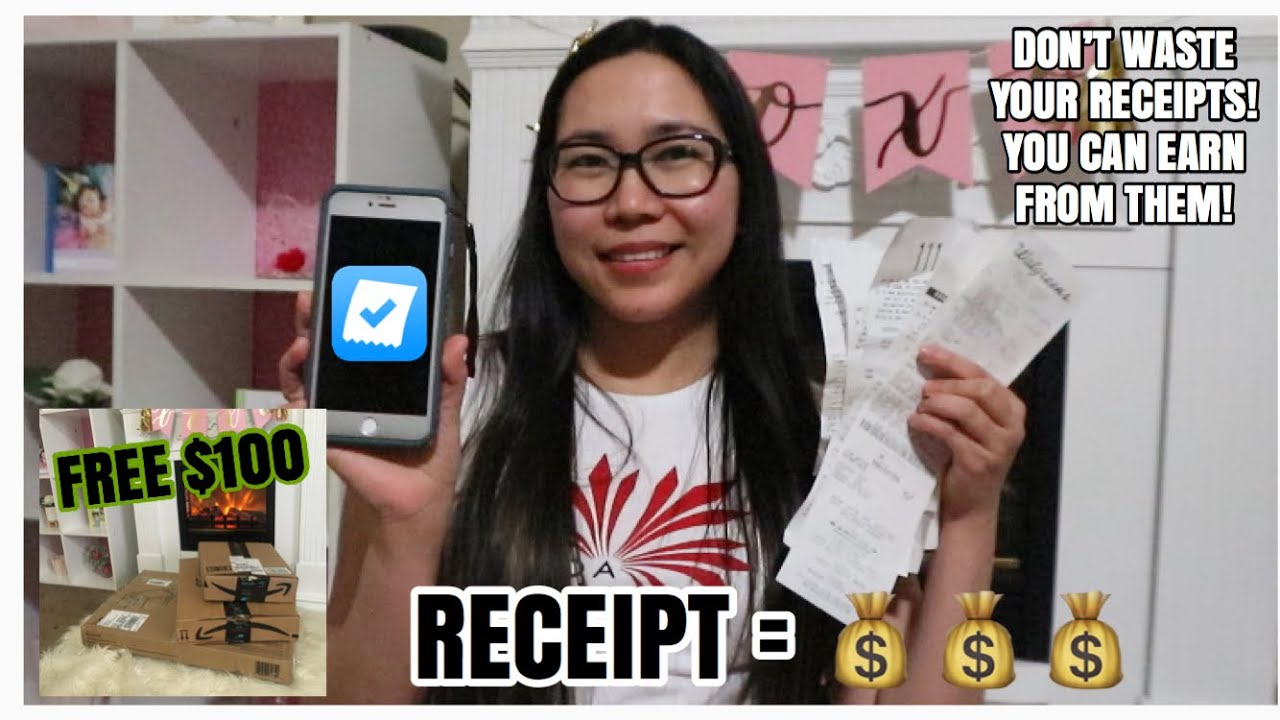

So what do you need to be aware of if you’re thinking of switching to a more environmentally friendly way of running your business. Well, the goods new is that yes, subject to certain rules, HMRC are more than happy to accept scanned and digital copies of paperwork – including scanned receipts and invoices. With the explosion of technology we often get asked whether HMRC will accept scanned receipts and invoices. Scanned Receipts And Invoices: Hmrc Requirements The app will organize and store receipts and tally your expenses, taking the guesswork out of calculating your deductions. Simply photograph your receipts within the app, and the program will allow you to categorize it accordingly and make any appropriate notes.Īpps like Everlance also allow you to store receipts securely for years, both on your device and through an encrypted cloud backup. The benefits of using an app like Everlance are numerous: the program allows you to automate your mileage and expense tracking and lets you track any expense at a momentâs notice. You have the option of setting up a storage system on your own, or using an app like Everlance.

You can certainly scan and file your receipts, but we like the convenience of snapping a picture on our phone or tablet and filing the image accordingly. Our favorite method to store and organize receipts for taxes, electronic records allow you to easily move your files around and make for quick access at your fingertips, wherever you are. Which Tax Receipts Should I Be Saving to File Taxes?

0 kommentar(er)

0 kommentar(er)